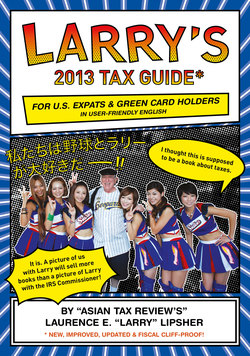

Larry's 2013 Tax Guide for U.S. Expats & Green Card Holders in User-Friendly English

Реклама. ООО «ЛитРес», ИНН: 7719571260.

Оглавление

Laurence E. 'Larry'. Larry's 2013 Tax Guide for U.S. Expats & Green Card Holders in User-Friendly English

Now, who the hell is Larry Lipsher?

A few dedications and a warning………

The sections of this book

The introduction

The final tax acts of 2012

O.K. Here’s my summary of that which I think you need to know about the new law…..My ‘top five’:

The other things I feel you should be aware of….

What is income

And now, for the very first time - at least as far as I know - your expat 2013 U.S. tax calendar:

Tax rules applying to you, the expatriate U.S. tax filer

Scenario # 1: You are moving from the U.S. to some strange, exotic land

Tax Home

The Bona Fide Residence Test

Scenario # 2: The expat who’s been overseas for years……

The Foreign Housing Exclusion

The Foreign Tax Credit

My Frequently asked questions by Expats Section....!

F(u)BAR & TDF90.22-1

In the beginning – a little bit of history

Penalties

TDF90.22-1 Report of Foreign Bank and Financial Accounts

What you've got to provide to the IRS

2012, 2013 and beyond – the latest in the IRS’s Voluntary Disclosure Program –

FATCA

O.K., you ask: how's the IRS going to enforce all of this?

Forms 2555 and 5471 (with mention about the partnership information return, Form 8865)

But first – a little bit about Form 2555

The Foreign Housing Exclusion (yes, it is part of Form 2555!)…again!

What is a 'Controlled Foreign Corporation'? What is Sub-Part F Income? What does it mean to you?????

Other things you should know about the Form 5471

AND FOR THOSE OF YOU WHO ARE PARTNERS IN A FOREIGN PARTNERSHIP – THERE IS FORM 8865! This form is similar to the 5471 but specifically for partnerships….

Form 8938….again,– for the very third time!

Night and day

The W-8 series of forms

O.K., O.K., so you do not have the new, improved (?), six-page forms…….what have we got for the current year: the one-page W-8BEN and the 1-1/2 page W-8IMY

W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding

Penalties, penalties….and more penalties

Schedule B of Form 1040 and TDF90.22-1 - the F(u)BAR penalties

Other forms, other penalties....

The AMT: Alternative Minimum Tax

Expatriation, the ‘ultimate’ experience

For those returning to their homeland: Expatriation - the ultimate 'tax experience'

Tax expatriation - yes, but you've got to 'surrender' to the IRS, as well.....

The ‘India Papers’

Son of FATCA

US Court Decisions and E-TRAK

150 + 544 = OUCH!

Phil’s List, Again

Sound international planning in the midst of a worldwide depression

The appendix

URLs for forms….

Publication 54 Tax Guide for U.S. Citizens and Resident Aliens Abroad, with highlights that are solely preferences of the author

Отрывок из книги

Laurence E. ‘Larry’ Lipsher is an American CPA who has been doing U.S. tax returns for the past 46 years. While he proudly states that over the past four plus decades on the job, he has yet to develop serious brain damage from a life of tax work, those around him seriously wonder. Lipsher has worked in Asia for a quarter of a century, living for 23 of those years, since 1990, in China.

Lipsher, a past president of the American Chamber of Commerce of South China, has, for the past eleven years been writing the bi-weekly Asian Tax Review for World Wide Tax Daily of Tax Analysts, Washington, DC. He has been featured on CCTV (China Central Television) World Wide Watch, the most widely viewed evening television news program in the world. He has also appeared on both CNN and CNBC. Lipsher specializes in tax issues involving nine tax jurisdictions within Asia as well as U.S. tax matters – particularly as they apply to U.S. tax filers living and working outside of the United States. Lipsher has lived in the Pearl River Delta capital city of Guangzhou since 1994. He is one of only a very few foreigners ever to have been given a business license to practice as a certified public accountant in the People’s Republic of China. He is the only non-Chinese writer ever to have articles (two of them) translated and published in the China Accountant, the official monthly publication of the Chinese Institute of Certified Public Accountants. Lipsher has also been writing monthly articles about international tax matters for TaxIndiaInternational.com

.....

It is with the permission and blessing of Tiger CFO (the Comptroller of our currencies) that I write this 2013 edition. It is to those of you who purchased the 2012 edition, bringing in sufficient royalties to cover the costs of writing this book whom I thank as well – without you guys covering the costs, Tiger CFO would have never given me permission! This book is priced to sell and, hopefully, both cynical enough, funny enough for you, the reader, to sit back and enjoy it.

The sad fact of the matter is that now, more than ever before, you, the reader are being held responsible for understanding an absolutely incomprehensible tax system because, if you do not cover your behind and file annually, you are deemed to be 'willfully negligent’ and subject to potential penalties, even though you do not owe any tax.

.....