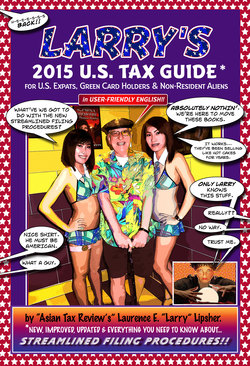

Larry's 2015 U.S. Tax Guide for U.S. Expats, Green Card Holders and Non-Resident Aliens in User-Friendly English

Реклама. ООО «ЛитРес», ИНН: 7719571260.

Оглавление

Laurence E. 'Larry'. Larry's 2015 U.S. Tax Guide for U.S. Expats, Green Card Holders and Non-Resident Aliens in User-Friendly English

Who the hell is Larry Lipsher (and why is he doing this)?

My not so infamous, semi-annotated Table of Contents

The introduction – for the sixth time I’m doing an introduction to a tax book

What is income?

Your expat 2015 U.S. tax calendar:

Tax rules applying to you, the expatriate U.S. tax filer

First, how to become an expat for tax filing purposes….

The Foreign Tax Credit

My Frequently asked questions by expats section....!

The Form 1040-NR ‘Section’

F(u)BAR & FinCEN114

In the beginning – a little bit of history

TDF90-22.1 Report of Foreign Bank and Financial Accounts – its sudden demise…..and the birth of FinCEN114

What you've got to provide to the IRS

What was required to be listed on the TDF and IS STILL REQUIRED on the FinCEN114:

Going online to efile FinCEN114

...And let us not forget those grand, glorious, awfully humungous F(u)BAR penalties!

FATCA

O.K., you ask: how's the IRS going to enforce all of this?

Is FATCA constitutional?

Tax forms that the overseas U.S. tax filer needs to know about

Form 1040, Schedule B, Interest and Dividends…..and Part III

FinCEN114

Form 1116 http://www.irs.gov/pub/irs-pdf/f1116.pdf

Form 8938 http://www.irs.gov/pub/irs-pdf/f8938.pdf

Night and day

What is a 'Controlled Foreign Corporation'? What is Sub-Part F Income? What does it mean to you?????

Form 14653 – hip hip hurray – the last form in this section!! - http://www.irs.gov/pub/irs-pdf/f8858sm.pdf. Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures

Banking, investing , the W-9 and W-8

O.K., O.K., so who uses what?

Obamacare

Social Security and Medicare - some thoughts on the matter for those of you within sight of those so-called 'retirement years'

Applying for Social Security

Medicare

A brief refresher about capital gains and losses

The AMT: Alternative Minimum Tax

So, what exactly is the AMT?

Penalties, penalties….and more penalties

Schedule B of Form 1040 and the FinCEN114, F(u)BAR penalties

Other forms, other penalties....

A few words about interest:

The Statute of Limitations and how to double it or worse!

The Offshore Voluntary Disclosure Program

2012 - the IRS’s Offshore Voluntary Disclosure Program (in essence, this one is still in effect!)

June 18, 2014 – a very welcomed Streamlined Change!

Giving and receiving

Giving – you don’t have to be rich to give but you still have to report it!

So you are planning to move back to the U.S

Planning ahead - some 'lifestyle' choices will have to be made!

Expatriation, as an alternative you might seriously want to consider….

Sound international planning in the midst of a worldwide depression

The sort of stuff one writes upon completion of a 6th book – my End Notes….

Отрывок из книги

Laurence E. 'Larry' Lipsher is an American CPA who has been doing U.S. tax returns for the past 48 years. Imagine, 48 years as a bean counter - how dreadfully boring! While he proudly states that over the past four-plus decades on the job, he has yet to develop serious brain damage from a life of tax work, those around him seriously wonder. Lipsher has worked in Asia for a quarter of a century, living for 24 of those years, since 1990, in China - he changed from being just a bean counter to, literally and figuratively being a rice counter , too, because CPA in Mandarin, really means rice counter!

Lipsher, a past president of the American Chamber of Commerce of South China, has, for the past twelve years been writing the Asian Tax Review for Worldwide Tax Daily of Tax Analysts, Washington, DC. He has been featured on CCTV (China Central Television) World Wide Watch, the most widely viewed evening television news program in the world. He appears frequently on CNN , Wall Street Journal television, Reuters TV and CNBC. Lipsher specializes in tax issues involving jurisdictions throughout Asia as well as U.S. tax matters – particularly as they apply to U.S. tax filers living and working outside of the United States. Lipsher has lived in the Pearl River Delta capital city of Guangzhou since 1994. He is one of only a very few foreigners ever to have been given a business license to practice as a certified public accountant in the People's Republic of China. He is the only non-Chinese writer ever to have articles (two of them) translated and published in the China Accountant, the official monthly publication of the Chinese Institute of Certified Public Accountants. Lipsher has also been writing monthly articles about international tax matters for TaxIndiaInternational.com. All in all Lipsher has written over 300 tax articles since his very first article appeared in the AICPA Journal of Accountancy in 1979.

.....

In ending the introduction to that 2011 edition, I wrote about Form 8938 and its introduction on the sly by the IRS during Thanksgiving week, when it would be least likely to attract any attention. This is year five for that form. Five consecutive years of form revisions and we are still without adequate instructions. That form, the 8938, is now supposedly error-free. If you believe that, then there is a bridge in Brooklyn I’d like to sell you – at a real bargain price!

I ended my 2012 introduction to this book with a notification issued by Merrill Lynch:

.....