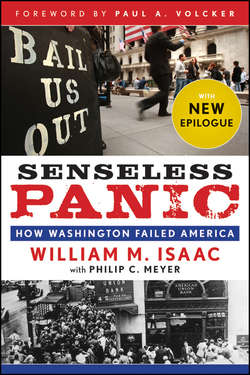

Описание книги

The truth about the 2008 economic crisis from a Washington insider The 1980s opened with the prime interest rate at an astonishing 21.5 percent, leading to a severe recession with unemployment reaching nearly 11 percent. Depression-like conditions befell the country, the entire thrift industry was badly insolvent and the major money center banks were loaded with third world debt. Some 3,000 bank and thrifts failed, including nine of Texas’ ten largest, and Continental Illinois, which, at the time, was the seventh largest bank in the nation. These severe conditions were not only handled without creating a panic, the economy actually embarked on the longest peacetime expansion in history. In Senseless Panic: How Washington Failed America, William M. Isaac, Chairman of the Federal Deposit Insurance Corporation (FDIC) during the banking and S&L crises of the 1980s, details what was different about 2008’s meltdown that allowed the failure of a comparative handful of institutions to nearly shut down the world’s financial system. The book also tells the rousing story of Isaac’s time at the FDIC. Details the mistakes that led to the panic of 2008 and 2009 An updated paperback revision of the bestselling book on the 2008 economic crisis, including a fascinating new Epilogue Demystifies the conditions America faced in 2008 Provides a road map for avoiding similar shutdowns and panics in the future Includes a foreword by Federal Reserve Chairman Paul Volcker Senseless Panic is a provocative, quick-paced, and thoughtful analysis of what went wrong with the nation's banking system, a blunt indictment of United States policy, and a road map for making sure it doesn’t happen again.