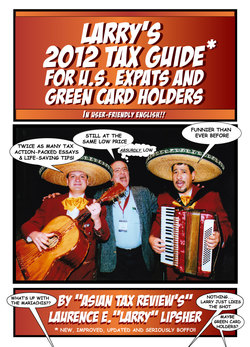

Читать книгу Larry's 2012 Tax Guide For U.S. Expats & Green Card Holders - In User-Friendly English! - Laurence E. 'Larry' - Страница 4

На сайте Литреса книга снята с продажи.

Introduction

Оглавление…..in the beginning…..there’s always got to be an INTRODUCTION: A literary (assuming you do not think that ‘tax literature’ is an oxymoron) wonder, this opening section – an absolutely delightful way to ease on down the tax system road that the IRS has placed before us! Not only are you sufficiently warned about the new goodies the IRS has added to your workload of ongoing tax obligations but if you die without having planned properly, even with a minimum estate, Merrill Lynch provides an example of how it will make it rough for your heirs to get that to which they are entitled…..and need!

Welcome, dear reader, to the 2012 edition of Larry's U.S. Tax Guide for Expats and Green Card Holders - in User-Friendly English! You guys are doing something very, very bold: you've actually purchased a book about the world's most confusing tax system. I am trying something equally as bold - to write a book that is readable! Now, my friends, go on and do something more bold than that: read the sections of this book which interest you.....you don't have to read the whole thing but read those sections that are applicable to you. You'll find it informative.....I guarantee it! Well.....not really an iron-clad guarantee. If you do not find it informative, I'm not going to give you your money back!

I'm in Shanghai as I start to write this book. Writing might be easier, this time around, as I've had a year to think this one out. Last year, I wrote as I thought.....and that thinking process, while obviously necessary, seemed to 'get in the way' of my being able to write. Last year, too, I got involved in a couple of 'huge' IRS tax audits/cases that some very large professional firms turned down because of 'fear': the fear of getting involved in situations that were essentially without precedent; the fear, perhaps, of being sued for choosing an approach to take in that audit/tax case that, in retrospect, might not have been the wisest of approaches to take. My advice to you all: DON'T BE AFRAID! The IRS is empowered by Congress to collect revenues but it is not funded adequately by that same Congress that empowers them. Computer generated letters are routinely sent by the IRS, assessing incorrect amounts. If you receive a letter from the IRS and it is wrong, then do not pay that assessment. Challenge the IRS: send them a response through registered mail, keeping that registered receipt (as well as a copy of what you send to the IRS - you'd be surprised how frequently I encounter clients who have kept neither and hence, cannot prove their compliance!). And be prepared to have to re-send that letter perhaps three or four times prior to the IRS recognizing that you are asking the IRS to correct their errors. I seriously wonder if the IRS would ever let us know how much money they collect from correspondence that should never have been sent out in the first place. Patience and patience and patience: don't give in to the IRS if you are right and they are wrong - unless, of course, that incorrect assessment and penalty is so small that it is cheaper to pay than to be bothered by it!

Last year, the first year of what will hopefully become an annual 'activity', I started writing 'Larry's 2011 Tax Guide for the U.S. Expat and Green Card Holder - In User-Friendly English' with a question. Well, a year later, as I start the 2012 edition, why change a successful way to start - I'll ask another, albeit, different question.

What do the governments of Greece, Italy and, I suppose, the United States have in common with my wife (aka 'Tiger CFO')? The answer: they all must have a balanced budget and reign in their respective deficits. Yet unlike those jurisdictions, Tiger CFO has definitely learned to cope with economic realities of life and has eliminated all of our credit card debt, bringing us peace of mind and a balanced budget!

One simply cannot say the same for the three governments mentioned above. It is entirely possible that the Euro, while likely to survive, will lose some nation-members in the coming year. It is equally likely that U.S. tax law will change, making life rough for the U.S. expat. Although, truth be told, those changes will likely come sometime in 2013, after a new administration takes office as a result of the 2012 elections. Yet beware - it is quite likely that even though new legislation will be voted upon by the two houses of Congress and signed by the President, mid-2013, that new legislation will be retroactive to 1 January 2013. Thus, some 'user-friendly' knowledge of the tax laws applicable to 2012 should be looked at quite seriously by the expat or green card holder because taxes (especially for capital gains) are likely to go up the year after (and for that you will simply have to read my 2013 edition!).

The United States has always functioned best when there is an outside enemy and it just seems possible that the U.S. expat will be the 'chosen target' this time. When was the last time you tried to open up a bank account using your U.S. passport as your nationality designated proof of who you are? Well let me tell you, my friends, you simply cannot - at an international bank - or any bank, for that matter, which has income producing assets in the United States. The FATCA section of this book will tell you why.

We expats have grown quite accustomed to both the foreign earned income and foreign housing exclusions. For the first time in the 21 years I've been an expat, I think we are in danger of losing them. Oh, all those apps I purchase through iTunes, which are paid through Apple's Luxembourg corporation are tax-free. Many U.S. corporations are tax-free and we, the tax filing (if not tax paying) individuals, are paying for this. We should definitely feel outraged by this but there is little we can do. Taxation without representation is tyranny.....and no, I am not a Tea Party believer!

Douglas Shulman, IRS Commissioner, to my knowledge, is still not filing his own tax returns - we should be annoyed about this because if the head honcho of the IRS has to pay someone else to prepare his tax return, what does that tell us? This is as outrageous to me as the bonuses being paid to Freddie Mac and Fannie Mae bosses - government bureaucrats (even if they do not view themselves as such) who, in spite of those humongous losses their respective, guaranteeing organizations have incurred, are getting bonuses more than 2-1/2 times their base salaries. More outrageous, though is the IRS's perception that the expat is a tax cheat! Why is the expat or green card holder lumped together with the domestic US tax filer with offshore accounts - our everyday needs are different but how can you explain this to our 536 elected officials (both Houses of Congress plus the President), most of whom do not have passports, who have never left the country, who simply cannot comprehend what it is like to be a U.S. tax filer outside of the U.S.?

It is with the permission and blessing of Tiger CFO (the Comptroller of our currencies) that I write this 2012 edition. This book is priced to sell and, hopefully, you will find it both cynical enough and funny enough for you, the reader, to sit back and enjoy it. I made more in royalties (all being declared on my tax return!) this past year than it cost me to self-publish. Not that much, though: enough to take our family to McDonalds a few times but hey, I'm not complaining - a profit is a profit is a profit! Yet I'm not spending those royalties on food (although those Big Macs are the ideal food to purchase prior to my train rides between Guangzhou and Hong Kong, trips I make, twice monthly) - I'm reinvesting the royalties in this, the 2012 edition....with Tiger CFO's whole hearted approval (especially since my waist line seems to expand, exponentially, with each of those Big Macs) !!!

The sad fact of the matter is that now, more than ever before, you, the reader are being held responsible for understanding an absolutely incomprehensible tax system because, if you do not cover your behind and file annually, you are deemed to be 'willfully neglect' and subject to potential penalties, even though you do not owe any tax.

Taxation is an issue that will help determine the results of the 2012 national elections. That growing gulf between the haves and the have nots of American society has manifested itself in the Occupy Wall Street movement. Yet what about those disenfranchised poor who do not pay taxes (and likely do not file tax returns, either? And what of those minorities living in the inner city barrios or ghettoes? They need assistance, usually provided by the states and municipalities, already cash strapped. Where's the tax money necessary for their assistance going to come from? Will there be a repetition in the cities of the U.S., this summer, similar to the U.K. riots last year? Hopefully not, but only time will tell.

Anyway, I've got to assume that you've read the 'preliminary' pages, prior to this, the actual 'introduction'. So what do you read next? Well, friends, simply go back a page or two and look at that 'annotated' table of contents. See which essays (and that is what I've essentially written - essays about certain areas which I believe are applicable to you, the overseas American tax filer) interest you. Read them! No, you do not have to read the whole shebang - read ONLY what interests you. If it doesn't interest you and you're reading late at night, then read that which does not interest you - it just might serve as a wonderful, holistic sleeping pill (especially the IRS instructions to those forms included within the appendix!).

Yeah, there are some sections that are repetitions of sections included last year. But no, these are not repeats, per se - for those few sections, there are some pretty decent re-writes contained within!!! If you are a 'new' reader to my writings and have not seen the 2011 edition, you might consider purchasing it, as well - it's affordable and contains information quite complementary to this edition!

In ending the introduction to that 2011 edition, I wrote about Form 8938, introduced on the sly by the IRS during Thanksgiving week, when it would be least likely to attract any attention. This year, that form, the 8938, is now revised, error-free, with its own separate set of instructions and is prominently featured in this edition with its very own, spine tingling essay, contained herein.......just enough to make you choke, without having swallowed a turkey bone!

It is the week before Thanksgiving as I write this intro and it is on Christmas Eve, 2011 that I review and do my edit. I'll end this introduction with something else brand spanking new that should give you cause for concern. It comes from Merrill Lynch, that brokerage house/investment bank that helped drive America to the verge of bankruptcy because of its greedy acts involving those lousy sub-prime mortgages.

Read the following, my friends. This was issued by Merrill Lynch this past week:

NOTICE TO ALL NON-U.S. INDIVIDUAL CLIENTS AND U.S. CITIZENS RESIDING ABROAD

“Certain U.S.-situs assets held within your account with Merrill Lynch may be subject to U.S. estate taxes in the event of your death. To ensure any U.S. estate tax liabilities are satisfied, U.S. law imposes a lien on all your assets held with Merrill Lynch at your death. As a result of this lien and the potential liability of Merrill Lynch for any unsatisfied U.S. estate tax, all of the assets in your account(s) with Merrill Lynch at your death will be restricted from withdrawal or transfer until (i) Merrill Lynch concludes that an exception applies based on an affidavit confirming your total U.S. assets held at death, your country of citizenship, and your country of permanent residence; (ii) Merrill Lynch receives documentation satisfactory to Merrill Lynch confirming that your assets are subject to a probate proceeding within the U.S.; or (iii) a release from the U.S. Internal Revenue Service (IRS), known as a 'Federal Transfer Certificate,' is provided to Merrill Lynch (obtaining this from the IRS can take up to a year or more). As Merrill Lynch does not provide tax advice, please seek guidance on this topic from your own legal or tax advisor.”

Guess what, dear readers: Merrill Lynch is not alone - all banks, brokerages and realty companies are starting to send out this notification. If you reside outside of the U.S. but have assets in the U.S., it is time to look at exactly how up-to-date your estate planning really is. True, we do not plan to die but sometimes we do and without some 'basic' planning, we are simply going to make life unbearable for our heirs......especially if one is a Non-Resident Alien with assets in the U.S. That NRA does not have the $US5 million exemption in 2011 or 2012: the NRA exemption is far lower - $US60,000.

It is for this reason that this year's edition includes a section devoted to gifts and the tax returns that go with giving – and receiving.

Read on.....enjoy.....and if you have any questions, email me at laoban@lifeilao.com. I don't guarantee that I'll answer you immediately, but I will definitely reply!!!