Читать книгу The Tax Analects of Li Fei Lao - Laurence E. 'Larry' - Страница 4

На сайте Литреса книга снята с продажи.

INTRODUCTION

ОглавлениеThe mainstream tax profession is just now learning, sometimes painfully, what business leaders have known for some time: our fledgling century does not belong to the West.

Money, power and influence still reside in places like New York and London — and will continue to do so for many decades to come. But there’s no denying that we’ve entered an era of intense economic globalization in which the titans of tomorrow might just as easily hail from China, South Asia, and the Pacific Rim.

Tax follows trade. So just as future MBA candidates rush to learn Mandarin, tax professionals around the world struggle to make sense of Asian tax systems. To their befuddlement, they are discovering exotic paradigms that share little conceptual similarity to the fiscal regimes back home.

Given the dearth of quality reference materials on point, the international tax community can breathe a collective sigh of relief that Laurence Lipsher has put pen to paper, creating a magnum opus that will benefit practitioners for generations to come.

For years, Lipsher has been the ‘go-to’ source for those seeking effective solutions to the thorniest of tax problems. He possesses a unique appreciation of not only the tax rules currently in force, but how these tax systems evolved over recent decades. That’s what sets Larry apart from the accountancy mills; he’s the guy who knows the right answer, and can concisely explain why it’s the right answer.

His knowledge base is genuine because he’s mastered the nuts and bolts of the Asian tax system from the inside — having now spent more than 23 years working in China and servicing clients across the region. This broad expertise is reflected in the range of jurisdictions addressed, including: China, Hong Kong, Macao, Taiwan, India, Singapore, Korea, Thailand, and Vietnam.

The practical benefits of this volume can be highlighted by informing readers of what they will not find in the pages that follow. You will not be exposed to the musings of an academic. Nor will you find the sanitized language of an industry spokesman. Lispher’s voice is one of real-world grit and authenticity. And no relevant topic is off limits; he tells it like it is. If that requires a frank discussion of corruption and its consequences for taxpayers, then so be it. He is at once an optimist and a realist.

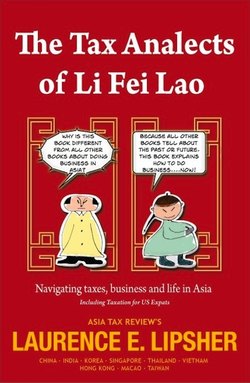

Seldom has a book on taxation been so entertaining to read. The avatar for Lipsher’s storytelling is Li Fei Lao, who — with his sidekick Xiao Go Pi — keep the chapters flowing. His chapters are laced with smart anecdotes and humorous personal observations. Lipsher continually invents improbable subjects around which he weaves articles that attract a wide and varied readership. Who else can choose as an essay topic the kangaroo fart and meaningfully tie it into taxation in India or China? Where but from Lipsher’s computer keyboard would one find articles including tax haikus or blues riffs?”

Above all else, Lipsher appreciates cross-border taxation as contextual human drama. Governments tax economic activity because they must. Politicians offer tax breaks to their constituents because they must. And taxpayers will move heaven and earth to reduce their tax burden, again, because they must. Hindus would characterize the balance as reciprocal dharma, each factor tugging the other in equal but opposite directions.

No matter how dense the legislative and regulatory details, we never stray too far from the author’s awareness that our tax systems — and especially Asian tax systems at this moment in their evolution — reflect a complex balance of social, cultural and commercial endeavors.

Robert Goulder

Editor-in-Chief, Tax Analysts

Washington, DC