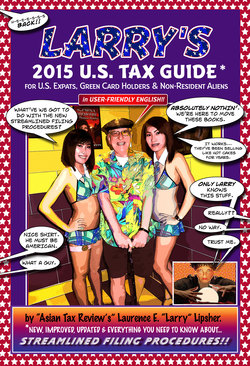

Читать книгу Larry's 2015 U.S. Tax Guide for U.S. Expats, Green Card Holders and Non-Resident Aliens in User-Friendly English - Laurence E. 'Larry' - Страница 4

На сайте Литреса книга снята с продажи.

My not so infamous, semi-annotated Table of Contents

ОглавлениеThe ‘preliminary’ stuff – you know, the sort of pages that are at the start of each and every book you see.

A book introduction for the very sixth time – where I start opinionating – with varying degrees of cynicism and humor thrown at the start to try to make things enjoyable

A ‘real’ executive summary of the U.S. tax system – as it applies to expats (both citizens and green card holders) and non-residents with ‘reportable’ U.S. investments (WARNING: some of this writing is quite boring!)

•What is income?

•‘The’ executive summary for overseas U.S. tax return filer

•FAQs

…..and here’s something for those who have to file the 1040-NR – My 1040-NR section

FATCA and FBAR – some history, how these programs have evolved, what’s now happening, what does the future portend (including the OECD’s CRS scheduled for 2017) – Hey, there are actually two sections here – if I do say so, myself, this is some good writing!

The forms you have to be aware of, living outside of the United States, cynically annotated but still boring!

Schedule B, Part 3 of the 1040

FinCEN 114

8938

2555

1116

8965

5471/8865

8858/8858 Schedule M

3520

8621

8832

14653

Banking and investing forms you are going to be asked for: W-9 and W-8 BEN E – This is the sort of stuff that makes for Kafka-esque, bureaucratic nightmares!

The Affordable Care Act (aka Obamacare), Social Security and Medicare – Should you be glad you live outside the US?

Capital gains and capital loss transactions – a refresher – before they change it and increase rates

The AMT – Always a system no one quite understands

Penalties, interest and the statute of limitations – Better to be aware of these – they truly can ruin you!

OVDP and the new Streamlined Procedures – note, there are different residency requirements, here!

Giving and receiving – you’ve got to report both giving (ever hear of the gift tax return?) and receiving – receiving from anyone, whether foreign trusts, gifts and bequests to you from either related or unrelated individuals (even if they are not US tax filers) will be costly if you do not report !

Returning to the United States after a lifetime overseas

Expatriation as an alternative that you might seriously want to consider – especially if you are an overseas business person and have to endure the indignities of FATCA

Comments after a lifetime of investing from a battle-scarred, (hopefully) wise, but lousy investor; thoughts about the investment needs of different generations…..and ‘letting go’…..

End notes – and that they will truly be: 9 February 2015 is the final day writing this book – after writing and giving myself a day to review the end notes and ascertain that I didn’t make a fool of myself, I’ll submit the manuscript to the publisher and begin my 49th consecutive tax season!!!!!