Читать книгу The Cost of Free Shipping - Группа авторов - Страница 14

На сайте Литреса книга снята с продажи.

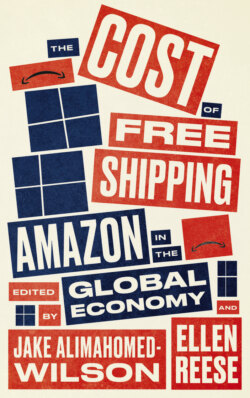

AMAZON’S GROWING MONOPOLY POWER AND CORPORATE DOMINANCE

ОглавлениеLaVecchia and Mitchell also rightly point to the growing monopoly power the corporation has gained through dominating “the underlying infrastructure—the online shopping platform, the shipping system, the cloud computing backbone—that competing firms depend on to transact business.”49 The rapid growth in Amazon’s online shopping platform, and the company’s use of this platform to both sell its own goods and those of other sellers, helps to illustrate their concerns.

As of 2020, there were over 150 million Amazon Prime members, making it the world’s second largest paid subscription program. Indeed, about 60 percent of American households are Amazon Prime members. Among the affluent, the numbers are even higher. A staggering 82 percent of households making more than US$112,000 per year are Amazon Prime members.50 Prime members pay an annual subscription fee in order to utilize Amazon’s platform and receive perks such as free, expedited shipping on millions of items purchased through Amazon. Amazon Prime membership is also growing rapidly among U.S. households earning less than US$50,000 annually,51 partly due to fee discounts of 50 percent or more for college students and very low-income households.52 To further reach the college student market, the “Amazon Campus” program created countless brick-and-mortar Amazon pick-up locations on university and college campuses throughout the United States, further exacerbating the privatization of public higher education. Although the company has lost money in the short term by offering its customers various perks and discounts, it helped the company to gain customer loyalty and market dominance. Amazon claimed nearly one of every two dollars in U.S. consumer purchases online.53

In this context, many sellers perceive few options other than to use Amazon.com to sell their goods. Amazon’s exploitative practices extend to third-party sellers who are charged a commission on their sales (usually 15 percent) made through Amazon.com as well as rising fees for using Amazon’s fulfillment, advertising, and other services.54 It also requires third-party sellers using Amazon’s platform to share information about their transactions, which the corporation uses to compete against them on popular items. The company has a long history of “predatory pricing,” or selling products below market cost in order to crush, outcompete, and sometimes even acquire other companies, such as Diaper.com and Zappos.55

Amazon uses transaction and consumer information from its online shopping platform to decide which products should be given the “buy box”—the eye-catching and convenient one-click “buy now” or “add to cart” buttons—that show up during online shopping searches. Amazon claims its mysterious algorithm that selects a default seller for the buy box is a neutral formula designed to maximize customer satisfaction. Yet, evidence suggests that Amazon gives itself a perfect score on measures of customer experience, giving it an unfair advantage over other sellers whose measures are affected by negative online customer reviews. The company also gives its Fulfillment By Amazon (FBA) warehouse and shipping service a perfect score for measures related to fulfilling orders, which both encourages sellers to use their delivery service and reduces accountability for problems with FBA’s deliveries.56 Other research finds that “about three-quarters of the time, Amazon placed its own products and those of companies that pay for its services in that position even when there were substantially cheaper offers available from others.”57 Likewise, Amazon’s voice assistant, Alexa, only chooses Amazon items when asked to purchase something. No wonder a 2016 survey of independent retailers in the U.S. identified competition from internet retailers such as Amazon as the number one threat to their business,58 and critics are linking the growth of Amazon to a decline in small businesses.59